The financial landscape is undergoing a profound transformation, spearheaded by the rise of fintech companies. One of the most significant players in this arena is FinTechZoom, an innovative firm making waves in the FTSE 100 index. This article delves into how FintechZoom is revolutionizing finance, its impact on the market, and what this means for the future of the financial sector.

The Rise of Fintech and FintechZoom’s Role

Fintech, short for financial technology, encompasses a broad range of companies that use technology to improve financial services. These include payment processing, lending, investment management, and more. FintechZoom has emerged as a leader in this space, leveraging cutting-edge technology to offer a suite of financial services that are more accessible, efficient, and user-friendly than traditional banking methods.

Founded in the early 2010s, Fintechzoom quickly gained traction by focusing on user-centric solutions. Its platform integrates artificial intelligence (AI) and machine learning to provide personalized financial advice, predictive analytics for investment, and automated customer service. This approach has not only attracted millions of users but also garnered the attention of major investors, propelling Fintechzoom into the FTSE 100.

Innovations Driving FintechZoom’s Success

Several key innovations underpin Fintechzoom’s success:

- AI-Powered Financial Services: FintechZoom uses AI to analyze vast amounts of data, offering users tailored financial advice and investment recommendations. This technology can predict market trends, helping users make informed decisions.

- Blockchain Technology: Blockchain ensures the security and transparency of transactions on FintechZoom’s platform. By utilizing decentralized ledgers, Fintechzoom enhances trust and reduces the risk of fraud.

- Mobile Accessibility: Fintechzoom’s mobile app allows users to manage their finances on the go. The app’s intuitive interface and comprehensive features make it a favorite among tech-savvy consumers.

- Open Banking: By embracing open banking principles, Fintechzoom allows users to aggregate all their financial information in one place. This integration provides a holistic view of their finances, enabling better management and planning.

- Regulatory Technology (RegTech): FinTechZoom employs RegTech to navigate complex regulatory environments seamlessly. Automated compliance checks ensure that the platform adheres to the latest financial regulations, protecting both the company and its users.

Impact on the Market and Traditional Financial Institutions

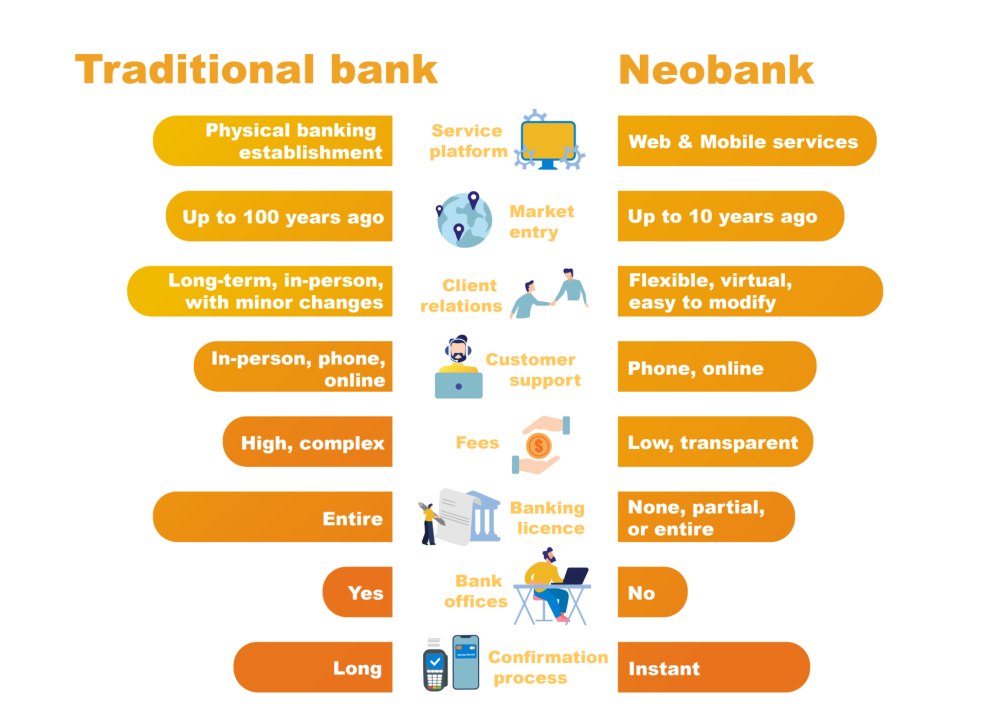

FintechZoom’s rapid ascent and innovative approach have significantly impacted the financial market. Traditional banks and financial institutions, once the undisputed leaders, are now facing stiff competition. Here are some ways Fintechzoom is reshaping the landscape:

- Democratization of Financial Services: FintechZoom has made financial services more accessible to a broader audience. Lower fees and user-friendly platforms attract individuals who previously found traditional banking cumbersome or exclusionary.

- Increased Competition: Traditional banks are now compelled to innovate to keep up with Fintechzoom. This competition benefits consumers through better services, lower costs, and more choices.

- Partnerships and Acquisitions: Many traditional financial institutions are partnering with or acquiring fintech companies like Fintechzoom to leverage their technology and innovation. These collaborations aim to integrate the agility of fintech with the stability and customer base of established banks.

- Enhanced Customer Experience: The emphasis on customer-centric solutions has pushed the entire industry towards improving customer experience. Fintechzoom’s success demonstrates that users prioritize convenience, personalization, and efficiency.

Challenges and Future Prospects

Despite its success, Fintechzoom faces several challenges. Regulatory hurdles, cybersecurity threats, and the need for constant innovation pose significant risks. However, the company’s proactive approach to these challenges suggests a promising future.

- Regulatory Compliance: Navigating the regulatory landscape is complex, especially as Fintechzoom operates globally. Staying compliant with varying regulations requires substantial resources and continuous monitoring.

- Cybersecurity: As a digital platform, Fintechzoom is a target for cyberattacks. Investing in robust security measures and staying ahead of potential threats is crucial for maintaining user trust and platform integrity.

- Market Volatility: The financial market is inherently volatile. Fintechzoom must adapt to changing market conditions and economic downturns to sustain its growth.

Looking ahead, FintechZoom’s future seems bright. The company’s commitment to innovation, user-centric approach, and strategic partnerships position it well for continued success. Here are some potential developments to watch:

- Expansion into Emerging Markets: FintechZoom has the opportunity to expand its services to emerging markets where traditional banking infrastructure is lacking. This expansion could bring financial inclusion to millions and drive further growth.

- Integration of Emerging Technologies: Technologies such as quantum computing and advanced AI could further enhance Fintechzoom’s capabilities. By staying at the forefront of technological advancements, Fintechzoom can continue to lead the industry.

- Sustainability Initiatives: As sustainability becomes a critical concern, Fintechzoom can integrate green finance principles into its operations. Sustainable investment options and eco-friendly practices could attract a new segment of environmentally conscious consumers.

- Enhanced Personalization: Future advancements in AI and data analytics will enable even greater personalization of financial services. Fintechzoom can offer hyper-personalized advice and solutions, further strengthening customer loyalty.

Conclusion

FinTechZoom’s rise to prominence within the FTSE 100 exemplifies the transformative power of fintech. By leveraging advanced technologies and focusing on user needs, FintechZoom has revolutionized the financial industry. As the company continues to innovate and expand, its impact on the market and traditional financial institutions will only grow. For consumers, investors, and the industry as a whole, Fintechzoom represents the future of finance—accessible, efficient, and ever-evolving.