With just few days left for income tax return filing due date, i.e. 31st July, 2017, it is always better to file your return early in order to avoid last minute rush. Filing of tax return is compulsory for every individual whose income exceeds basic exemption limit. The basic exemption limit for individuals is Rs 2.5 lakh and Rs 3 lakh for senior citizens. Also, if there is any refund that you need to claim in your income tax return due to excess deduction of TDS you need to e-file your income tax return.

E-filing is a process that involves a good amount of interpretation of Income Tax Act. It requires you to refer many documents such as Form 16/16A, Form 26AS, Bank statements, Aadhaar, PAN etc. before filing return. If the whole tax filing process makes you feel worried, then ClearTax can help you make tax filing a breeze. You can easily file your return in just a few minutes through ClearTax platform and avoid all the hassles associated with return filing.  Just upload Form 16 and ClearTax software reads your Form 16 and automatically prepares the tax returns for you. All you then have to do is verify the information and submit it to finish e-filing.

Just upload Form 16 and ClearTax software reads your Form 16 and automatically prepares the tax returns for you. All you then have to do is verify the information and submit it to finish e-filing.

Here is the step by step guide for e-filing return through ClearTax Platform:

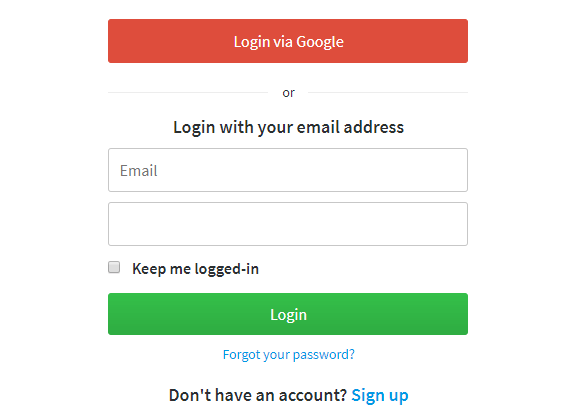

Step 1. Login to your ClearTax account. You can also use your Google account to login to ClearTax.

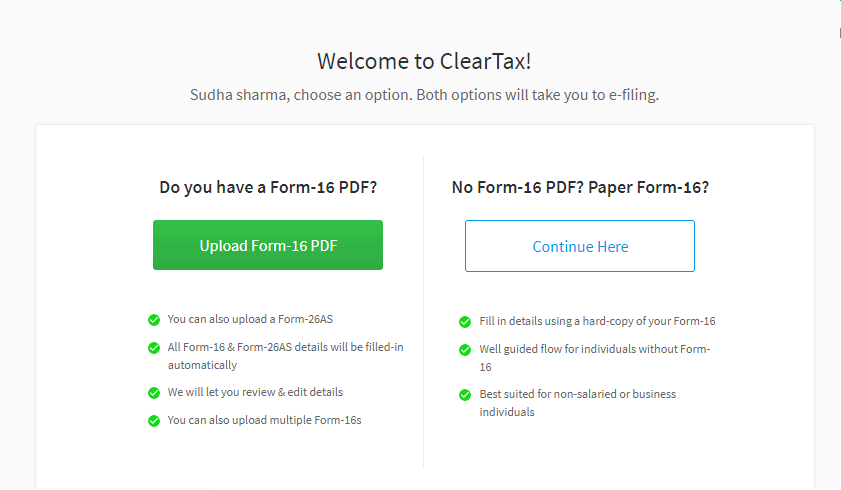

Step 2: Once you logged in, you will see two options. If you have Form 16, then click on ‘Upload Form-16 PDF’. Your salary income details will be automatically entered in the relevant places. If you don’t have Form 16, then click on ‘Continue Here’.

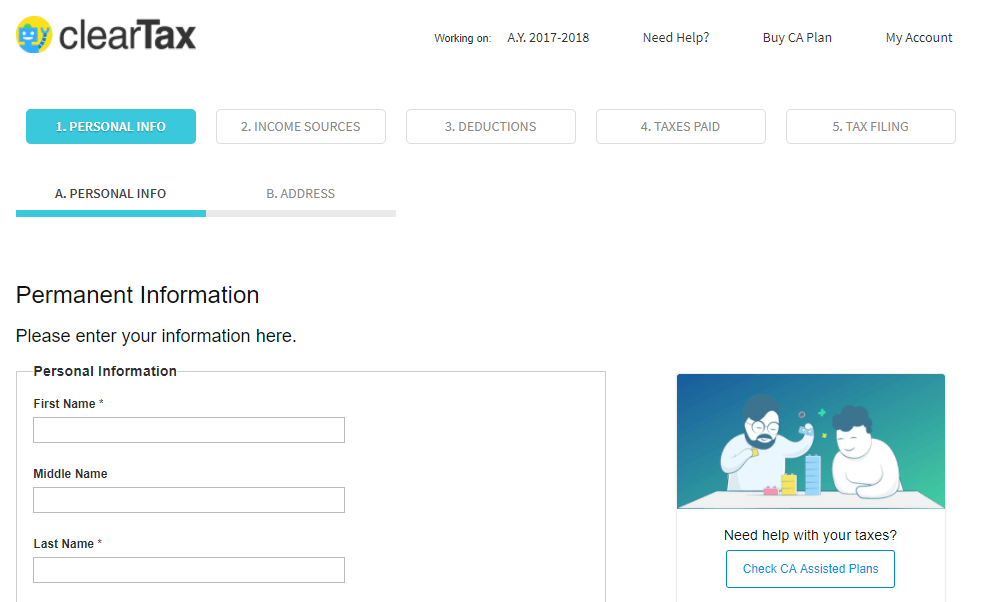

Step 3: Enter the Personal Info like Name, PAN, Date of Birth, Address and Aadhaar Number.

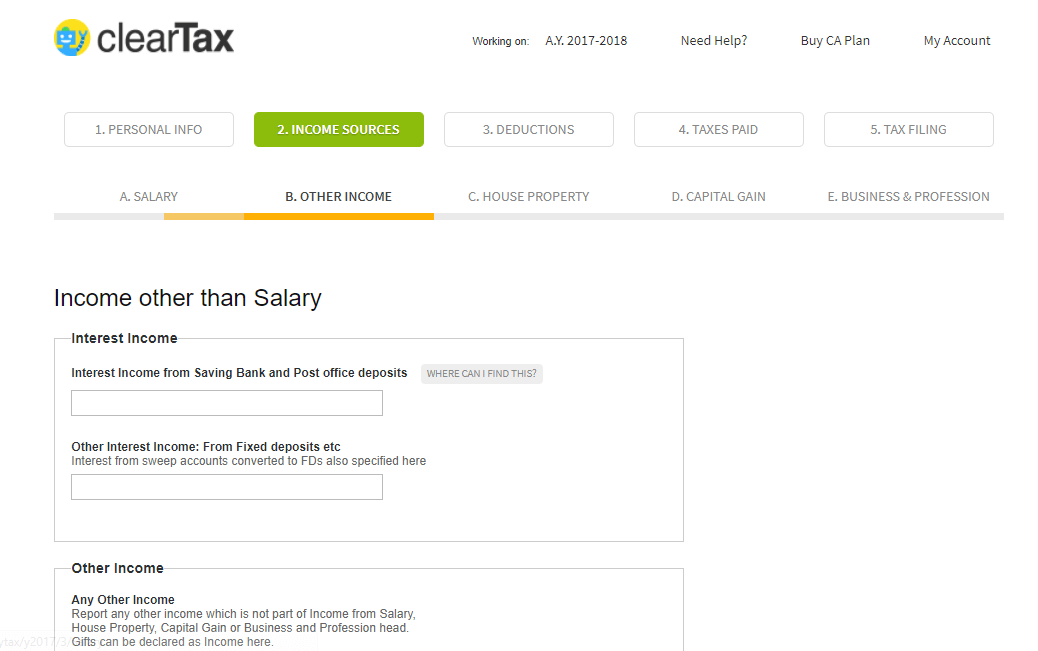

Step 4: Enter details of any other income that you have like – fixed deposit interest, savings bank interest, exempt income, etc. under ‘Income Sources’ – ‘Other Income’

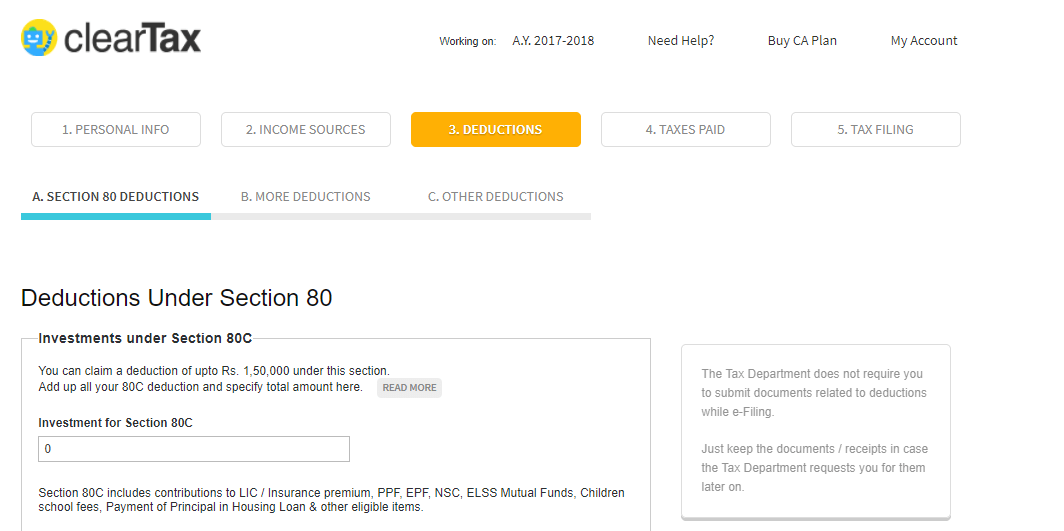

Step 5: Claim your deductions from the income. Enter investment details under Section 80C (e.g. LIC, PPF, ELSS, tuition fees, etc.) and other deductions that did not form part of your Form 16.

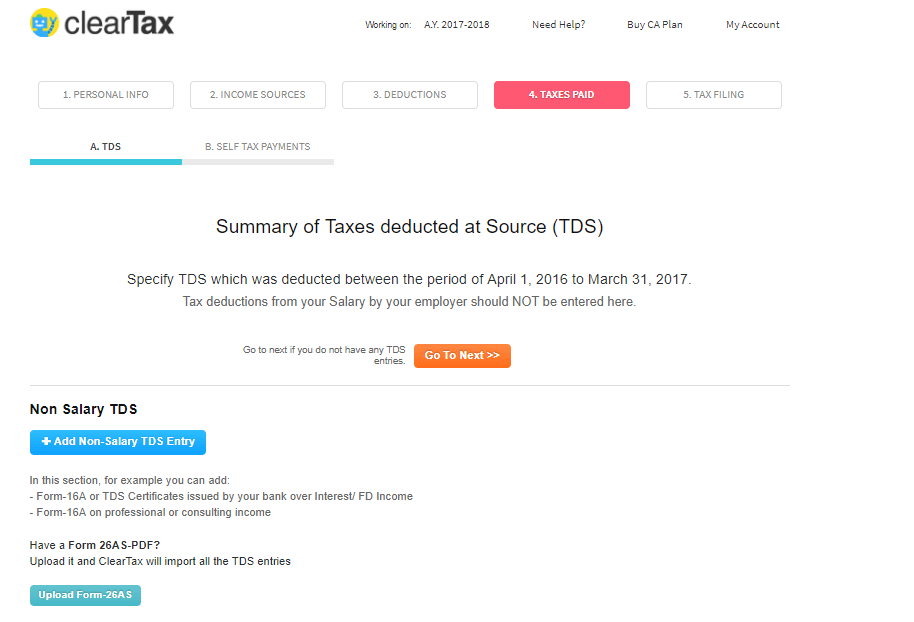

Step 6: Add details of taxes paid. If you have any non-salary income and TDS has been deducted on the same, e.g. interest income, then make sure you mention TDS deducted on such income. You can also add these details by uploading your Form 26AS.

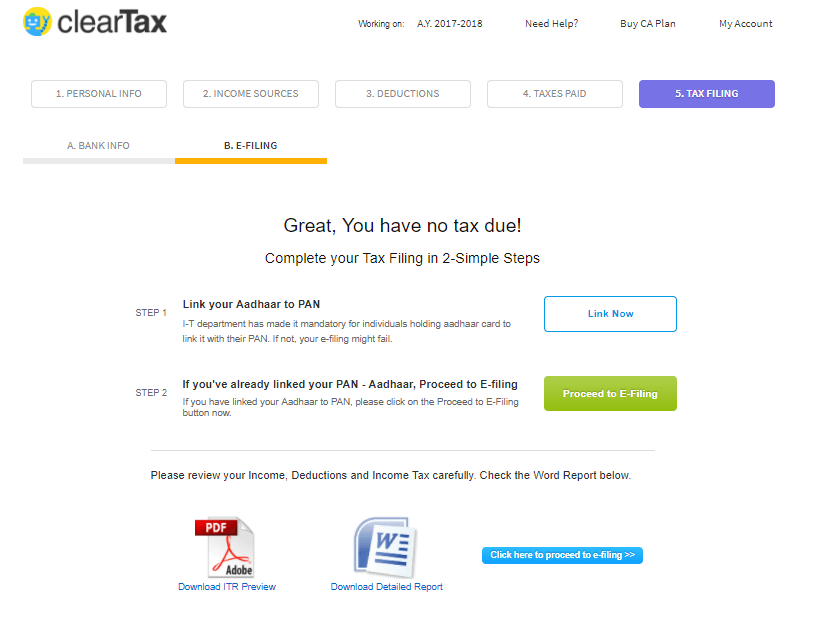

Step 7: The last step is to E-file your return. If you see “Refund” or “No Tax Due” on this page, click on proceed to E-Filing. You will get an acknowledgement number on the next screen.

Step 8: Once your return is filed. E-Verify your income tax return. E-verifying your income tax return is the last and final step that is required to complete your return filing process.

If you have changed the jobs during the year you will end up with multiple Form 16. You can upload more than one Form 16 and once again, get your tax returns prepared automatically by ClearTax software.

In case you have income from any other source and are wondering how to file your returns you can write to ClearTax Support on support@cleartax.in

ClearTax also offers expert plans where Tax Experts help with filing your returns making sure you claim maximum tax benefits and also help in tax planning for next year.

Very helpful tips. Simple to access.

Form 16 is a certificate of TDS on salary. Every employer issues Form 16 to an employee after the end of a Financial year.